No Win, No Repayment

No Upfront Payments or Fees

Pay Nothing Out of Pocket

Paperless Process

Same-Day Funding

Term-Based Payback

Chances are, legal funding is a much simpler process than you think. Before looking into obtaining settlement funding, however, you need to make sure that you have already retained a personal injury attorney to handle your accident claim. A settlement cash advance is not for the purpose of paying for an attorney. An attorney will not be paid up front for injury claims.

Once this is in place, you should fill out our online form which outlines the basic details of your accident. We combine this information with data we collect from your attorney to determine what a fair amount of funding to offer you.

We will then make you a funding offer, of which you may accept as much as you think is necessary to sustain you through the litigation process. This cash funding is typically needed by clients who have bills to pay and are often unable to work because of the injuries sustained in the accident. It is also a more convenient and practical alternative to lawsuit loans that must be paid back in full.

Once you have retained an attorney, this is the time to speak with Fund Capital America about getting a lawsuit cash advance. You need to give your attorney the time they need to litigate effectively rather than settling early to obtain your settlement, and because such injury claims can take so long, pre-settlement funding is the optimal way to get a cash advance on your settlement. It can enable you to pay your bills and living expenses until your case is resolved.

Your attorney will begin a preliminary investigation to determine 3 things:

Your personal injury attorney will make use of all relevant case information and documentation such as records, police reports, medical statements, and other related evidence compiled to resolve the claim. The goal is to accomplish this without the need for courtroom litigation to ensure a quicker settlement. Your attorney may send a Demand Package to the insurance company if they believe an easy settlement is possible, otherwise they will file suit against the insurance company. The insurance company then assesses the claim and makes an initial settlement offer. Only in rare cases will the insurance company offer the maximum amount of the insurance policy. You, as the injured party, may decide to accept the settlement or not.

If the insurance company is unwilling to offer you the financial compensation you deserve, your attorney can file a formal injury lawsuit which could eventually bring your case to court.

Mediation is a way of resolving disputes between attorneys who are attempting to land on an agreeable settlement amount. A judge may order Mediation before proceeding to trial wherein a third party, or Mediator, assists in helping parties reach a settlement. Once a settlement is reached, the insurance company issues compensation within weeks and the lawsuit is dropped.

Otherwise, the case may be tried before a judge or a jury depending on the extent of the claim. A trial can last days or months or even years and can cost a lot of money in lawyer fees, which is where our settlement loans alternative helps. There is no way to accurately predict the outcome of the case, and insurance companies typically have huge budgets to pay elite attorneys.

There are several important things to know when you are looking for legal funding. If you don’t know what criteria to judge a lawsuit funding company by, you might end up making the wrong decisions. The qualities you should consider in your due diligence include:

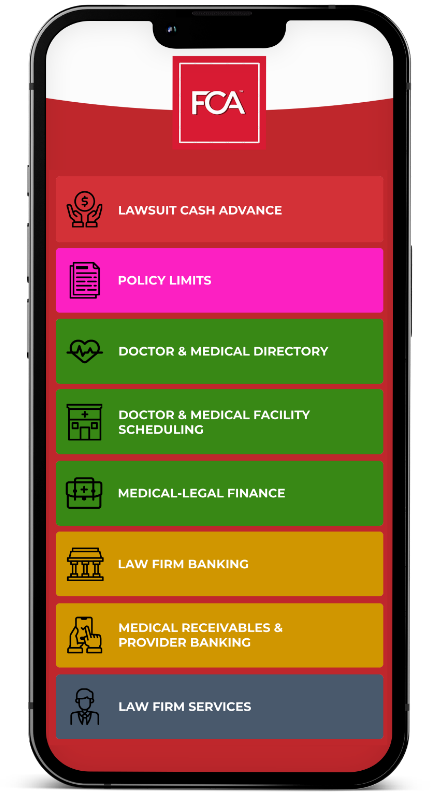

With Fund Capital America, the terms always include:

When you are approved for a settlement cash advance, you do not have to wait to receive your funds. We offer same day funding. There is no delay in having the cash you need to cover your expenses (Fund Capital America offers an advance of up to $100,000 in 24 hours). This can be particularly useful if you are injured and unable to work.

The legal funding process is simple: the complainant, or injured party, contacts Fund Capital America for financial assistance with paying their expenses while unable to work. The latter would then request detailed case documentation from the complainant’s attorney.

The entire process is paperless.

Once all the information is gathered, it is carefully reviewed by Fund Capital America to determine the viability of the case. Once approved, a drafted agreement is sent to the complainant and their attorney. During the process, the funds are sent to be used as needed by the applicant.

The cash you receive can be used immediately to your advantage. Plaintiffs who are seeking a lawsuit have often been through something that has affected their earning capacity, such as an injury or loss of employment. With the money received through pre-settlement funding, you can:

For those seriously injured in an accident, Fund Capital America can work directly with you and your attorney to forward you the cash you need within 24 hours of filling out our online application. There is no paperwork involved and no credit check is required. Unlike lawsuit loans, your cash advance is based solely on the merits of your case! In the event that your case is lost, you won’t have to repay anything.

Fund Capital America is highly rated, so our services are highly regarded among clients. Your approval for a settlement cash advance is dependent only on the facts of the case. Just request an amount and submit your application. We also use a completely paperless system, so the process is fast, simple, and convenient. There’s no added stress on top of an already difficult situation you may already be facing. Here at Fund Capital America, we also serve other states, not just in California.

Check our user reviews and see why Fund Capital America is Top Pre-Settlement Funding Company

"*" indicates required fields

"*" indicates required fields